View Advisory as PDF

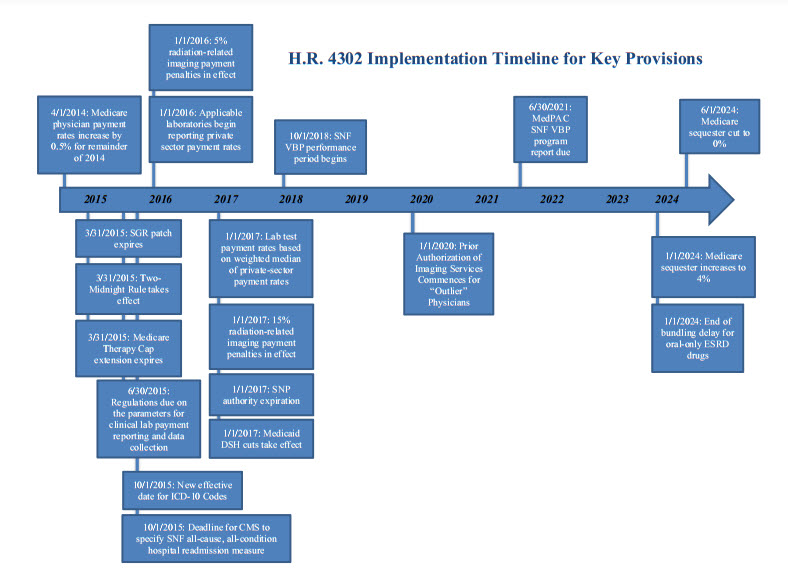

President Obama signed the “Protecting Access to Medicare Act of 2014” (Public Law No. 113.93) into law on April 1, 2014. The measure passed the Senate late on March 31 by a vote of 64 to 35 and passed the House by voice vote on March 27. Congress passed the law up against the deadline to prevent Medicare physician payment cuts from taking effect, when efforts to reach an agreement on offsets to pay for a permanent physician payment fix fell short. In addition to a “fix” that prevented a scheduled shortfall for physician payments that will last until March 31, 2015, the legislation includes extensions for a number of other Medicare and Medicaid policies and some significant policy changes for multiple sectors of the health care industry. Notable provisions are described below. An implementation timeline is attached.

Cross-Sector Medicare Provisions

- Sequestration (§222). To bring more savings into the budget window, this provision “realigns” the Medicare sequester by doubling the sequester amount to four percent in the first six months of fiscal year 2024, and eliminating it in the last six months of that year. Reduces spending by $4.9 billion/11 years.

- Delay of ICD-10 Implementation (§212). Prior to October 1, 2015, this provision provides that the Secretary may not accept ICD-10 codes sets as standard “medical data code sets” for purposes of the Health Insurance Portability and Accountability Act (HIPAA). This effectively delays implementation of ICD-10 for one additional year. Negligible score.

- Extension of Medicare Therapy Cap Exceptions Process (§103). This provision extends the Medicare therapy cap exceptions process through March 31, 2015. Medicare sets annual per-beneficiary payment limits for outpatient therapy services, provided by therapists and other eligible professionals in certain settings, as follows: $1,920 for physical therapy and speech-language pathology services combined, and $1,920 for occupational therapy services. This provision provides an exception to the outpatient therapy caps if the therapy is determined to be medically necessary. Increases spending by $800 million/11 years.

Physicians

- Sustainable Growth Rate Formula Override (§101). This provision blocks Sustainable Growth Rate (SGR) formula cuts until March 31, 2015, avoiding an estimated 24-percent cut to Medicare reimbursement rates for physician services. Payments to physicians for treating Medicare beneficiaries will maintain the 0.5-percent increase for the remainder of 2014 that applied in January through March of 2014. The bill includes a zero-percent update for January 1, 2015, through March 31, 2015. Increases spending by $15.8 billion/11 years.

- Information Collection (§220). Under this provision, the Secretary will have the authority to collect information on direct and indirect resources for furnishing services (including time, practice expense inputs and overhead) through billing systems, EHRs and other mechanisms. This information may be used to establish or adjust practice expense relative value units (PE RVUs). The Secretary will have the authority to consider additional factors when examining potentially misvalued codes, including codes that account for the majority of spending under the Physician Fee Schedule (PFS), codes for services that have experienced a substantial change in the hospital length of stay or procedure time, codes for which there may be a change in the typical site of service since the code was last valued, codes for which there are anomalies in the relative values within a family of codes and codes for services where there may be efficiencies when a service is furnished at the same time as other services, among other factors. Significant RVU reductions will be phased in over a period of time. Reduces spending by $4 billion/11 years.

- Medicare Work Geographic Practice Cost Index (GPCI) Floor (§102). This provision provides a one-year extension of the Medicare GPCI floor through March 31, 2015, increasing physician reimbursement rates in primarily rural areas. Increases spending by $300 million/11 years.

Hospitals

- Low-Volume Hospitals (§105). This provision extends the low-volume payment adjustment through March 31, 2015. Under the provision, low-volume hospitals will continue to be defined as hospitals that are more than 15 road miles from another comparable hospital and have up to 1,600 Medicare discharges. Qualifying low-volume hospitals will receive an add-on payment to their inpatient prospective payment system (IPPS) rate that ranges from 25 percent for hospitals with fewer than 200 Medicare discharges to no adjustment for hospitals with more than 1,600 Medicare discharges. Increases spending by $300 million/11years.

- Medicare-Dependent Hospitals (MDH) (§106). This provision extends the MDH program through March 31, 2015. An MDH is defined as a hospital that is located in a rural area, has no more than 100 beds, is not classified as a sole community hospital and has at least 60 percent of inpatient days or discharges covered by Medicare. Under the MDH program, MDH hospitals receive the sum of their IPPS rate, plus 75 percent of the amount by which their cost per discharge exceeds the IPPS rate. Increases spending by $100 million/11 years.

- Extension of Two-Midnight Rule for Hospitals (§111). This provision extends the delay in enforcement of the Medicare two-midnight policy for an additional six months, through March 31, 2015. Specifically, recovery audit contractors (RACs) are prohibited from auditing inpatient claims spanning less than two midnights for the six-month period; instead, the “probe and education” program for auditing hospital discharges around the two-midnight policy is extended for six months. Negligible score.

- Medicaid Disproportionate Share Hospital (DSH) Payments (§221). This provision extends the ACA’s Medicaid DSH payment reductions through FY 2024; however, it delays implementation of the Medicaid DSH cuts until FY 2017. The DSH cuts are now as follows: $1.8 billion in FY 2017; $4.7 billion in FYs 2018, 2019 and 2020; $4.8 billion in FY 2021; $5 billion in FYs 2022 and 2023; and $4.4 billion in FY 2024. The provision also requires the Medicaid and CHIP Payment and Access Commission (MACPAC) to review and submit an annual report on Medicaid DSH payments. Reduces spending by$4.4 billion/11 years.

- GAO Report on Children’s Hospital GME Program (§214). This provision requires a Government Accountability Office (GAO) evaluation of the Children’s Hospital Graduate Medical Education (GME) Program by November 30, 2017. No score.

Post-Acute Care Providers

- Technical Changes to Long-Term Care Hospitals (LTCHs) (§112). This provision makes technical corrections to the LTCH site-neutral payment policy to clarify that only Medicare fee-for-service discharges will be used to calculate the numerator and denominator of the LTCH discharge payment percentage. This provision also establishes an exception to the building moratorium for LTCHs. To qualify for the exception, proposed LTCHs and satellites under development must have satisfied one of the following by the date of the bill’s enactment: (1) begun their qualifying period for payment as an LTCH; (2) entered into a binding written agreement with an outside, unrelated party for the actual construction, renovation, lease or demolition, and have expended at least 10 percent of the estimated cost of the project (or, if less, $2.5 million); or (3) obtained a certificate of need, as may be required, in a certificate-of-need state. Increases spending by $100 million over 11 years.

- Skilled Nursing Facilities (SNFs) (§215).

- Value-Based Purchasing (VPB) Program. Under this provision, the Secretary is required to establish an SNF VBP program where value-based incentive payments are made in a fiscal year to SNFs, beginning with services furnished beginning October 1, 2018. An SNF all-cause, all-condition hospital readmission measure—specified by Centers for Medicare and Medicaid Services (CMS) not later than October 1, 2015—will apply under the SNF VBP program, and “as soon as practicable” will be replaced by an all-condition, risk-adjusted, potentially preventable hospital readmission rate for SNFs.

- The Secretary is required to rank SNFs based on their achievement (relative to other SNFs) and improvement (relative to that particular SNF in the prior fiscal year) performance scores based on standards established by the Secretary. The Secretary is required to determine a performance and ranking methodology. This ranking will determine SNF VBP incentive payments.

- To fund the incentive payment pool, the Secretary is required to withhold two percent of SNF payments. The Secretary is then required to redistribute 50 to 70 percent of the withheld amount by way of incentive payments to SNFs. SNFs with the highest rankings will receive the highest incentive payments, and SNFs with the lowest rankings will receive the lowest performance payments. SNFs ranking in the bottom 40 percent will see their rates reduced relative to what would have occurred without the SNF VBP program. SNF performance payment rates will be based on the higher of SNF’s achievement and improvement score.

- The Medicare Payment Advisory Commission (MedPAC) will be required to issue a report to Congress no later than June 30, 2021, examining the SNF VBP program.

- Reduces spending by $2 billion/11 years.

End-Stage Renal Disease (ESRD) (§217)

-

This provision delays the inclusion of the payment for the oral-only ESRD drugs in the Medicare per-dialysis treatment bundled payment rate from 2016 until 2024. The provision also mitigates the payment reductions required by the American Taxpayer Relief Act of 2012 (ATRA) by eliminating such cuts after 2015, and partially replacing them with a 1.25-percent market basket reduction for 2016 and 2017, and a one-percent reduction for 2018.

-

Additionally, the provision requires CMS in 2016 to establish a process, through promulgation of annual payment rules, for (1) determining when a product is no longer an oral-only drug; and (2) including new injectable and intravenous products into the bundled payment. The provision also establishes quality measures related to conditions treated by oral-only drugs under the Quality Incentive Program. Finally, beginning in 2012, the provision requires audits of cost reports as required by MedPAC.

-

Reduces spending by $1.8 billion/11 years.

Clinical Laboratories (§216)

- Technological Changes. Under this provision, CMS no longer has the authority to adjust prices on the Medicare Clinical Laboratory Fee Schedule (CLFS) based on “technological changes” to laboratory tests. CMS engaged in rulemaking on this topic in 2013 and was to begin proposing new prices in the coming months.

- Reporting Private Sector Payment Rates. This provision reforms the CLFS such that, beginning in 2017, rates paid to clinical laboratories by private payors will be used to determine Medicare rates for laboratory tests. Every three years, laboratories that receive a majority of their Medicare reimbursement under the Medicare CLFS or PFS will be required to report to the Secretary of Health and Human Services the payment rates paid by each private payor during a specified reporting period, and the volume of such tests for each payor for the period.

- Payment for Clinical Diagnostic Laboratory Tests. Payment for laboratory tests furnished on or after January 1, 2017, including hospital lab tests that are not bundled, will be equal to the weighted median of private payor rates in the most recent data-collection period, subject to a limitation on the amount a price could be reduced from year to year. Once a payment amount is established, it will be effective until the year after the next data-collection period.

- Payment for New Advanced Diagnostic Laboratory Tests. Certain laboratory tests offered only by one lab that have not been paid under the CLFS prior to enactment of the legislation will be paid initially at the list charge and then at an amount equal to the weighted median of private payor rates.

- Payment for Other New Tests. Other new tests that are not considered “advanced diagnostic laboratory tests” will be priced through cross-walking (applying prices for tests that are similar or use similar resources) or gapfilling (Medicare contractors develop specific prices, and in the second year, the National Limitation Amount is the median of the contractor-developed prices).

- Clinical Laboratory Advisory Panel. The Secretary will establish a clinical laboratory advisory panel to provide input on the establishment of payment rates and the factors that should be considered.

- Coverage Policies. Beginning in 2015, Medicare contractors may issue coverage policies for clinical diagnostic laboratory tests only in accordance with the process for making a Local Coverage Determination, including the appeals and review process. The Secretary may designate one or more contractors to establish coverage policies and/or process claims for clinical laboratory tests.

- Reduces spending by $2.5 billion/11 years.

Medical Imaging (§218)

- Radiation-Related Payment Policies.

- Under this provision, beginning in 2016, most computed tomography (CT) imaging services performed using older equipment that does not meet the National Electrical Manufacturers Association (NEMA) Standard Attributes for CT Equipment Related to Dose Optimization and Management will be assessed either a five-percent payment penalty on Outpatient Prospective Payment System (OPPS) reimbursement (for hospital outpatient departments) or a five-percent penalty on the technical component for Medicare PFS reimbursement (for physician office settings). The payment increases to 15 percent for 2017 and all subsequent years. Providers must attest to using NEMA standard-conforming CT equipment in order to avoid the payment penalties.

- The Secretary has authority to update the applicable CT equipment standard through rulemaking, as the current NEMA standard (specified in the legislation) eventually becomes outdated.

-

Appropriate Use Criteria for Physicians Ordering Advanced Imaging Services.

- This provision provides that, beginning in 2017, CMS will only allow OPPS and PFS payments to providers for advanced imaging services if the provider furnishing the service includes information on the claim for reimbursement that shows that (1) the ordering physician consulted with appropriate use criteria (AUC) for imaging services before ordering the advanced imaging service; and (2) indicates whether the imaging order adheres with the applicable AUC.

- The AUC consultation requirement does not apply to advanced imaging services that are furnished during an inpatient hospital stay, imaging services that are ordered for an individual with an emergency medical condition as defined under the Emergency Medical Treatment & Labor Act (EMTALA) or imaging services ordered by certain professionals that can claim a “hardship” (e.g., lack of Internet access).

- By November 15, 2015, the Secretary must specify one or more AUC(s).

- By April 1, 2016, the Secretary must identify and publish a list of qualified clinical decision support (CDS) mechanisms that could be used by ordering professionals to consult with applicable AUC.

- Beginning in 2017 and in subsequent years, the Secretary will identify “outlier” ordering professionals that have particularly low rates of AUC adherence as compared to their peers, based on the previous two years of claims data. Starting in 2020, outlier ordering physicians will be required to obtain prior authorization from CMS before advanced imaging orders can be furnished.

- Reduces spending by $200 million/11 years.

Health Plans

- Elimination of Limitation on Deductibles for Employer-Sponsored Health Plans (§213). This provision eliminates the provision adopted in the Affordable Care Act capping deductibles for fully insured small group health plans at $2,000 for self-only policies and $4,000 for family coverage. The provision is effective as if included in the ACA. This does not affect other provisions—e.g., out of pocket limits and metal tier requirements will continue to apply. No score.

- Medicare Special Needs Plans (SNPs) (§107). This provision provides a one-year extension of authority for all SNPs with no policy changes. SNP authority now goes until 2017. Increases spending by $200 million/11 years.

- Medicare Cost Plans (§108). This provision provides a one-year extension for Medicare cost plans with no policy changes. The current-law market text for reasonable-cost contracts is delayed until January 1, 2016. Increases spending by $100 million/11 years.

Other Provisions

- Medicare Ambulance Add-Ons (§104). This provision extends increased Medicare rates for ambulance services for one year, through March 31, 2015. Increases spending by $100 million/11 years.

- Funding for National Quality Forum (NQF) Quality Measurement (§109). This provision extends funding for NQF, the health care performance measure-setting body, through the first six months of fiscal year 2015. Negligible score.

- Funding Outreach and Assistance for Low-Income Programs (§110). This provision extends funding for the following programs through March 31, 2015: State Health Insurance Counseling Programs (SHIPs); Area Agencies on Aging (AAAs); Aging and Disability Resource Centers (ADRCs); and the National Center for Benefits Outreach and Enrollment. Negligible score.

- Qualifying Individual (QI) Program (§201). This provision extends through March 2015 capped allotments to states to pay the Part B premium for low-income Medicare beneficiaries between 120 and 135 percent of the federal poverty level. Increases spending by $800 million/11 years.

- Transitional Medical Assistance (TMA) (§202). This provision extends the TMA program, which allows low-income families to maintain Medicaid coverage as they transition into employment, for one year, until March 31, 2015. Negligible score.

- Medicaid and CHIP Express Lane Option (§203). This provision extends the program facilitating simplified Medicaid and Children’s Health Insurance Program (CHIP) eligibility determinations and enrollment for one year, until September 30, 2015. Negligible score.

- Special Diabetes Program for Type 1 Diabetes and Indians (§204). This provision extends diabetes prevention, education and treatment programs for one year, until September 30, 2015. Increases spending by $300 million/11 years.

- Abstinence Education (§205). This provision extends the abstinence education program for one year, until September 30, 2015. Negligible score.

- Personal Responsibility Education Program (PREP) (§206). This provision extends the PREP, which educates young people on abstinence and contraception to prevent pregnancy and sexually transmitted infections, for one year, until September 30, 2015. Increases spending by $100 million/11 years.

- Family-to-Family Health Information Centers (F2F HIC) (§207). This provision extends a program funding grants for families of children with special health care needs through March 31, 2015. Negligible score.

- Health Workforce Demo for Low-Income Individuals (§208). This provision extends the Health Workforce Demo for Low-Income Individuals for one year, through September 30, 2015. Increases spending by $100 million/11 years.

- Maternal, Infant, & Early Child Home Visiting Programs (§209). This provision extends funding for programs to improve health and development outcomes for at-risk children through March 31, 2015. Increases spending by $400 million/11 years.

- Pediatric Quality Measures (§210). This provision continues funding for pediatric quality measures and eliminates a restriction related to funding for the Medicaid Quality Measurement Program. No score.

- Medicaid Third-Party Liability Settlements (§211). This provision delays the effective date for Medicaid amendments related to beneficiary liability settlements for two years, until October 1, 2016. Increases spending by $200 million/11 years.

- Demonstration Programs to Improve Community Mental Health Services (§223). This provision establishes a two-year, eight-state demonstration program to incentivize community mental health providers to offer a broad range of mental health services. Increases spending by $1.1 billion/11 years.

- Assisted Outpatient Treatment Grant Program for Individuals with Mental Illness (§224). This provision authorizes four years of funding for demonstration grants for local jurisdictions to implement programs for individuals with serious mental illness. No score.

- Funding from Transitional Fund for SGR Reform (§219). This provision uses funds set aside in the Bipartisan Budget Act of 2013 to help offset the cost of the bill. Reduces spending by $2.3 billion/11 years.

This advisory is published by Alston & Bird LLP’s Health Care practice area to provide a summary of significant developments to our clients and friends. It is intended to be informational and does not constitute legal advice regarding any specific situation. This material may also be considered attorney advertising under court rules of certain jurisdictions.