Foreign direct investment (FDI) screening identifies and addresses risks for national security or public order by controlling foreign investments into strategic domestic undertakings.

In 2020, the EU adopted Regulation (EU) 2019/452 as a framework for the screening of FDI into the EU. However, unlike in merger control, there is no one-stop-shop EU-level regime. FDI screening is a Member State matter. The FDI Regulation just sets out minimum requirements for the domestic regimes and provides for a cooperation mechanism under which Member States and the European Commission can issue comments and opinions on transactions involving FDI in any Member State. So far, 24 Member States have adopted an FDI screening regime. The remaining three Member States have initiated legislative steps to introduce a regime.

Germany is among the jurisdictions with a high number of investments in domestic companies and, therefore, has a very active regime covering a broad catalogue of critical economic sectors. A few weeks ago, the German Federal Ministry for Economic Affairs and Climate Action (BMWK) published facts and figures of its 2024 enforcement activity.

The German Regime in a Nutshell

German FDI screening rules may apply when a non-German investor acquires, depending on the sector concerned, at least 10% or 20% of the voting rights in a German company, either directly or indirectly by acquiring a parent company located anywhere in the world with a German subsidiary. Subsequent filings will be required each time the foreign investor increases its voting rights above 20%, 25%, 40%, 50%, and 75%.

If the German target company is active in the fields of military and defense goods or in IT for processing classified information, the regime applies to any foreign investor, including those from other EU/EFTA Member States (sector-specific review).

For many other business activities, including critical infrastructure, telecommunications, media, or “emerging technologies” such as cloud computing, telematics, essential medicines, medical devices, satellite services, AI, biotech, autonomous driving, robotics, fine mechanics, and data networks, the regime applies only to non-EU/EFTA investors (cross-sectoral review).

Target Industries and Origin of Investors in 2024

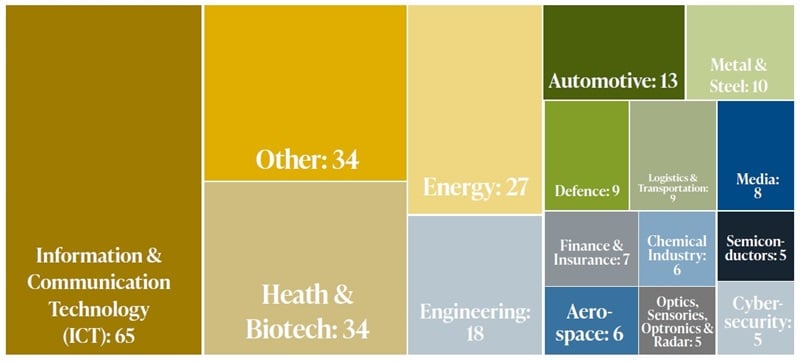

Given the broad scope of industry sectors captured, the number of German FDI screening cases has more than doubled, from 106 cases in 2019 to 261 in 2024. Around one-quarter of the German FDI screening cases in 2024 related to targets active in the information and communication technology sector, followed by health and biotech and energy.

Sectors of Target Companies in German FDI Screening Cases Filed in 2024

Source: BMWK, Investment Screening in Germany: Facts & Figures, 31 January 2025

The top three countries of investors’ origin are the United States, followed by the UK and China.

Origin of Investors in German FDI Screening Cases Filed in 2024

Source: BMWK, Investment Screening in Germany: Facts & Figures, 31 January 2025

Impact on Deal Process and Timeline

A notifiable transaction must not be closed before approval from the BMWK. The initial review period (Phase I) can take up to two months. An in-depth investigation (Phase II) can take up to four months. The BMWK can extend the review period by an additional three to four months. Most cases (62%) were cleared within 40 days, while 11% of the cases took more than 60 days. Only about 7% of the cases were subject to a Phase II investigation.

Beyond the mandatory regime, the BMWK can pick up any other foreign investment of at least 25% of the voting rights in a German target within five years from signing. To obtain legal certainty in candidate cases, parties can apply for a certificate of non-objection. This will trigger the statutory review periods.

Examples of Substantive Outcomes and Outlook

In the last years, prominent prohibitions included proposed Chinese investments into an energy transmission system, into a supplier of the army with high-purity minor metals used in semiconductors and of germanium used in infrared detectors, and into a supplier of radio technologies and microelectronics.

A Chinese investor proposing to acquire a manufacturer of thin metal used in the automotive and nuclear industries abandoned the transaction as a reaction to the regulators’ concerns. The acquisition of a German semiconductor manufacturer by a Taiwanese investor failed because the takeover bid expired during the BMWK’s review.

A Chinese investment into a port container terminal was only partially approved, requiring the investment to remain below 25% of the voting rights. The acquisition of a German manufacturer of heat pumps by a U.S. company was cleared under the condition that the parties comply with the agreed rules on the securing of domestic sites.

These are just a few examples, and there are more cases of critical review or conditional approval. The growing number of cases per year is an expression of the wide scope of application of the German FDI regime, based on low thresholds and a broad catalogue of relevant industries. A changing climate affecting global trade policies and geopolitical tensions will likely increase the intensity of scrutiny and the duration of FDI reviews, not only in Germany but across the EU. Dealmakers should assess the potential exposure early on and be prepared to liaise with the governments in charge as soon as possible to increase deal security and the chances of a swift review.

You can subscribe to future advisories and other Alston & Bird publications by completing our publications subscription form.

If you have any questions, or would like additional information, please contact one of the attorneys on our Antitrust team.