Welcome to Alston & Bird’s fourth quarterly update. In this issue, we share insights on the rise of the GP capital market and provide a secondaries market snapshot.

INSIGHTS – THE RISE OF THE GP CAPITAL MARKET

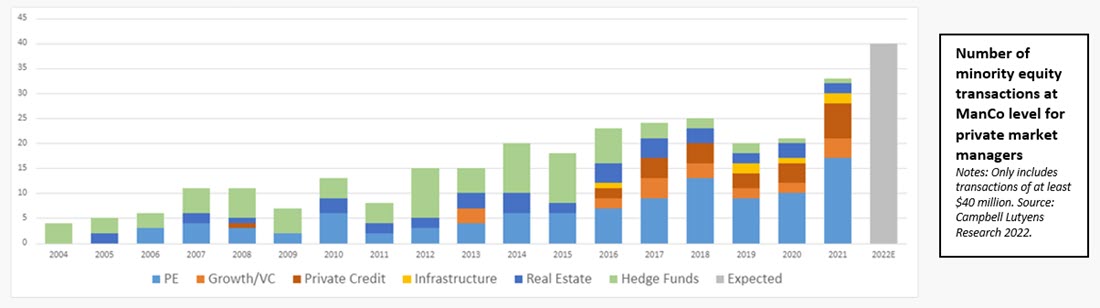

Thomas Liaudet, Partner at Campbell Lutyens and Global Head of GP Capital Advisory, provides this quarter’s insight. After decades of relatively steady, but quiet, growth, the GP capital market is finally approaching maturity in the private markets. The market comprises the financing of general partners (GPs) at the management company (ManCo) level, typically through the form of minority equity transactions. Campbell Lutyens estimate that about 214 transactions have taken place since 2012, with just over a third of those having closed in the past three years alone.

Below, Campbell Lutyens explore nine drivers underpinning the growth of this market.

- Succession management

With generations of private market fund managers preparing to step down, a minority transaction helps provide an alternative to what may have typically been a GP valuation based on retained earnings or other metrics, which usually does not reflect its true market value. A minority transaction supports succession by (1) setting an independent, external pricing of the ManCo; and (2) providing capital, thus bridging the financial wealth gap that may exist between different generations. - Legacy sponsor replacement

It’s not uncommon for GPs that were born out of a spinout from a financial institution to find themselves with a passive minority stake that had been granted to the parent at inception. With legacy sponsor replacements, both parties can benefit. For the GP, it might be desirable to replace the original cornerstone ManCo investor and welcome a new minority partner, which might be better suited to support it going forward. For the financial institution, the transaction can enable it to achieve liquidity for its investment. - Talent management

Minority stake transactions offer the ability to re-organise or implement a wider equity pool for the fund manager. In a world where the war for investment talent has intensified, the equity pool can offer the ability to better finance a succession as well as grant shares with a vesting period and avoid a penal tax bill up front, whilst valuing the GP closer to market value for its original founders. - Boosting GP commitments

2% seems to be the new 1% when it comes to GP commitments to new funds being raised. Furthermore, with the acceleration of flagship fundraising and the pressure to launch platform extensions, the quantum and the frequency of GP commitments become a real challenge for many fund managers. The proceeds of the minority stakes help to finance GP commitments; it’s also common that the structuring includes non-dilutive preference equity alongside. - Strengthening the balance sheet

Even the most successful fund managers tend to be relatively balance-sheet light, relative to companies of similar profitability operating in other industries. The proceeds of a minority transaction may be directed towards accelerated hiring, developing larger operating teams, or opening new offices. The key element to consider is time and how the minority capital may support the GP in accelerating its development. - Acquiring large LP stakes

As the secondary market has matured over the years, most GPs of scale will see a steady amount of secondary trading in their own funds. The GP capital financing can support the GP that seeks to buy back a limited partner (LP) interest in one of its own funds, with LTVs of up to 80% being achievable. That particular type of GP financing, like the financing of GP commitments, tends to be structured through an acquiring special-purpose vehicle structure with preference equity financing, rather than an equity deal at the ManCo level. - Consolidating the industry

When considering expanding across asset classes and geographies, GPs have to consider that hiring a team, seeding them, and raising the first two funds may take anywhere from two to three years or more. The alternative is to acquire another fund manager that fits the GP’s criteria for expansion. Again, the proceeds of a GP minority capital transaction may be directed towards financing all or part of such acquisitions. - Building a strategic partnership

A number of minority capital investors will offer significant financial flexibility for the structuring of the transaction and will remain passive, non-controlling minority investors. However, a large portion of the market includes investors who bring more than capital. In particular, they could bring expertise such as the ability to penetrate new geographies, special distribution channels (e.g. access to HNW or retail networks), strategic advice, access to talent pools, etc. No investor has an exhaustive offering, but several can offer a compelling strategic partnership to the GP. As part of this, LP capital can play a dominant dimension in the strategic partnership with the investor offering material LP capital in the form of multiple fund commitments or through separately managed accounts. - Managing the GP valuation path

This is a more recent approach that a small number of GPs have undertaken. The objective is to manage the path to the finish line, whether via an IPO, a trade sale, or an in-house succession. A minority transaction sets the GP valuation at a given point in time and provides more perspective at the next valuation event. The trajectory between two valuation events can be better articulated against growth of assets under management (AUM) and the development of fee-related earnings and performance-related earnings.

Conclusion

In Campbell Lutyens’ experience, there are usually at least two, if not three or four, of the above factors that lead to a minority transaction for a GP ManCo.

In the face of increased demand, the universe of investors targeting these transactions, whether systematically or opportunistically, has developed dramatically in the past few years, with about $50 billion of capital targeting the space. Overall, Campbell Lutyens expect this market to continue growing as the race for AUM accelerates across the private markets and as GPs become increasingly sophisticated in managing their own firms.

Thomas is a Partner at Campbell Lutyens, where he leads the global GP Capital Advisory practice, advising private market fund managers on such topics and transactions. He has 24 years of experience in private markets. Campbell Lutyens is a leading global and independent private market advisor, focused on fund placement, secondary advisory, and GP capital advisory, with 180 employees in eight offices across North America, Europe, and Asia-Pacific.

MARKET SNAPSHOT

This quarter’s secondaries market snapshot is provided courtesy of the Private Capital Advisory Group at Jefferies LLC:

- Q1 2022 brought a record number of LP portfolios to market – representing over $20 billion of exposure.

- Challenging macroeconomic conditions (record inflation, rising rates/recession risk, Russia–Ukraine war, extended portfolio exits/slowing distributions) have pulled LP pricing off the record highs seen in Q4 2021.

- Buyout pricing saw a 500bps decline from Q4, while Venture saw an over 1,000bps pricing decline due to these conditions.

- More than 75% of LP portfolios brought to market included a venture component – more than half of LP sellers in Q1 noted they are overweight private funds.

- The GP-led market continued its pace from 2H 2022 as single-asset continuation vehicles are explored by sponsors of all sizes and strategies.

- Public market valuation correction has impacted tech and venture GP-led deals as buyers target opportunities in traditional PE end markets (Consumer & Industrials) with valuations they can support.

Alston & Bird’s EU Women’s Initiative is producing a podcast series, Open Forum, where our attorneys and their professional connections delve into timely topics. We invite you to listen here!

Alston & Bird’s Private Funds & Secondaries Bulletin is produced by Alston & Bird’s Financial Services & Products Group and is edited by Saloni Joshi, Megan Lau, Lauren Burton, and Rob Davidson.